Facts About Clark Wealth Partners Uncovered

Wiki Article

Not known Factual Statements About Clark Wealth Partners

Table of ContentsGet This Report about Clark Wealth PartnersClark Wealth Partners Fundamentals ExplainedWhat Does Clark Wealth Partners Do?All about Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.What Does Clark Wealth Partners Mean?Things about Clark Wealth PartnersNot known Details About Clark Wealth Partners

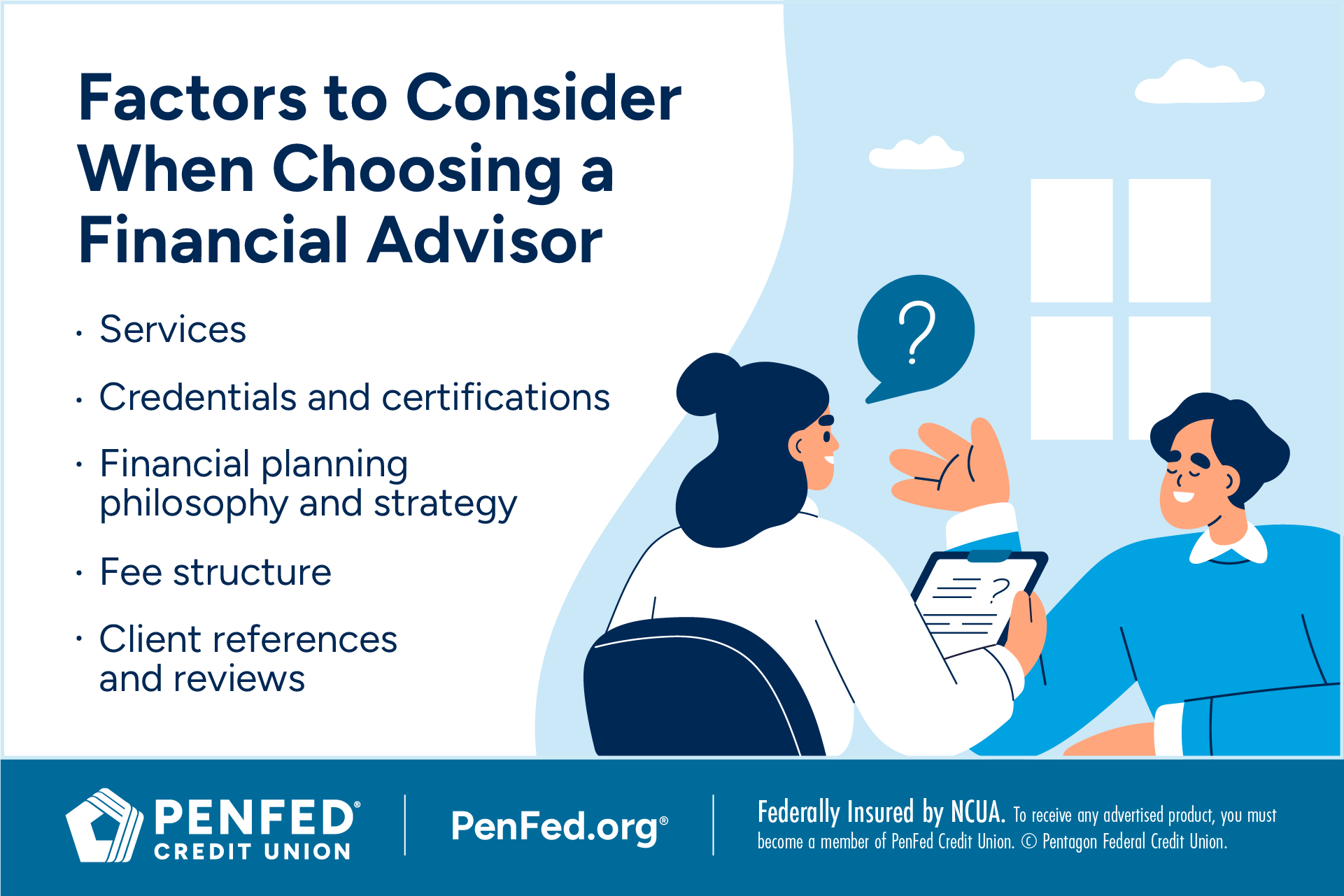

Common factors to take into consideration a financial advisor are: If your economic situation has ended up being extra intricate, or you lack self-confidence in your money-managing skills. Saving or browsing major life events like marital relationship, divorce, youngsters, inheritance, or task adjustment that might significantly affect your monetary circumstance. Navigating the shift from saving for retirement to preserving riches throughout retired life and how to create a solid retirement revenue plan.New innovation has brought about even more comprehensive automated financial devices, like robo-advisors. It depends on you to investigate and determine the appropriate fit - https://www.intensedebate.com/profiles/jovialtotallyfc8f11b0da. Inevitably, a good monetary advisor needs to be as mindful of your investments as they are with their very own, preventing extreme costs, conserving cash on taxes, and being as clear as feasible about your gains and losses

The Ultimate Guide To Clark Wealth Partners

Earning a payment on item recommendations doesn't necessarily mean your fee-based expert antagonizes your benefits. Yet they might be more inclined to suggest items and services on which they make a compensation, which might or may not remain in your ideal rate of interest. A fiduciary is legally bound to put their customer's passions.This typical enables them to make suggestions for investments and solutions as long as they match their customer's objectives, risk resistance, and monetary situation. On the various other hand, fiduciary advisors are lawfully obligated to act in their client's ideal interest rather than their own.

Some Known Factual Statements About Clark Wealth Partners

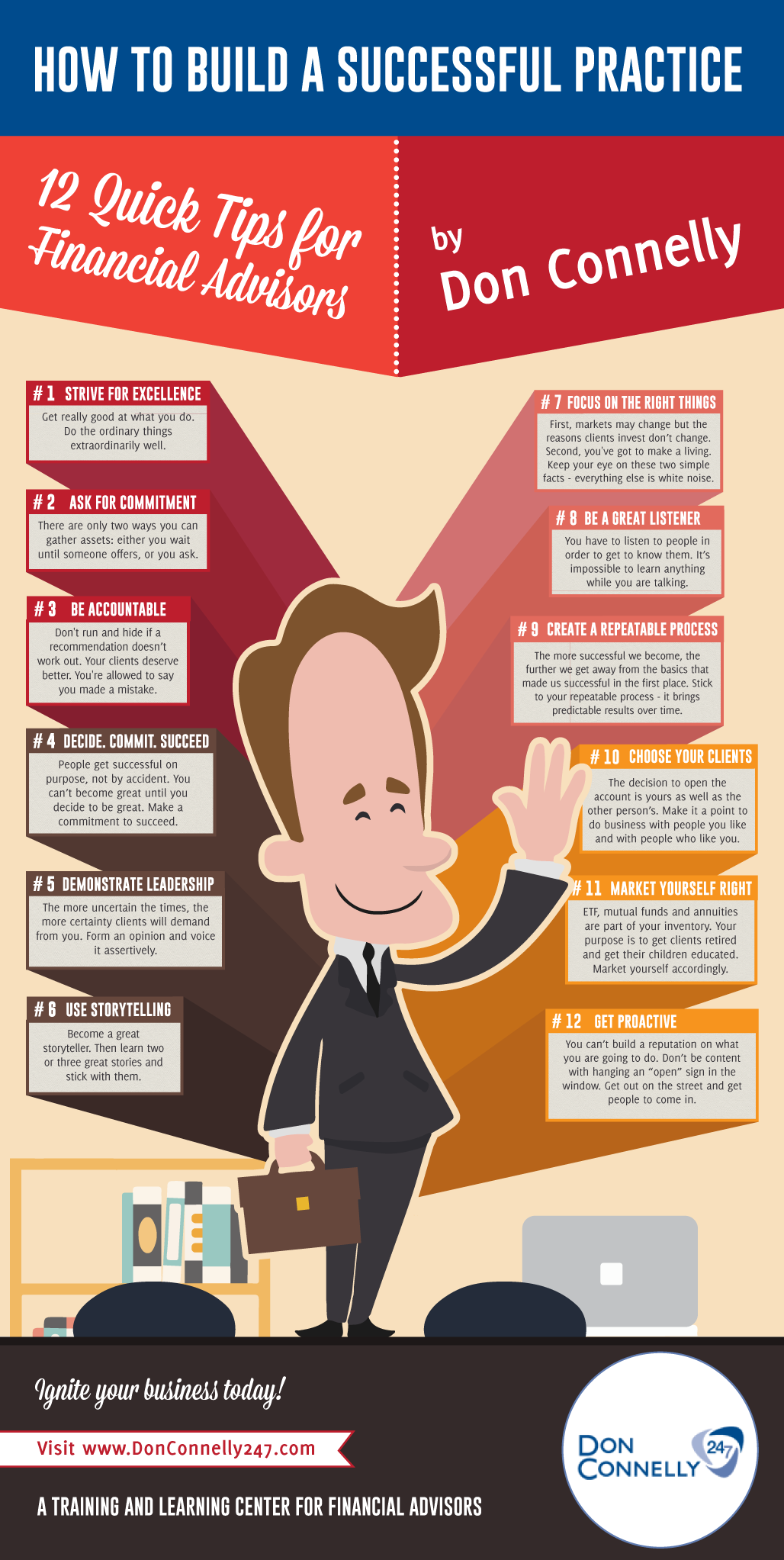

ExperienceTessa reported on all points investing deep-diving into complicated economic topics, dropping light on lesser-known financial investment opportunities, and uncovering ways visitors can work the system to their advantage. As an individual finance professional in her 20s, Tessa is really mindful of the impacts time and uncertainty have on your financial investment choices.

It was a targeted advertisement, and it worked. Learn more Read less.

All About Clark Wealth Partners

There's no solitary path to ending up being one, with some individuals beginning in banking or insurance, while others start in accountancy. A four-year level gives a solid structure for occupations in financial investments, budgeting, and customer solutions.

The Main Principles Of Clark Wealth Partners

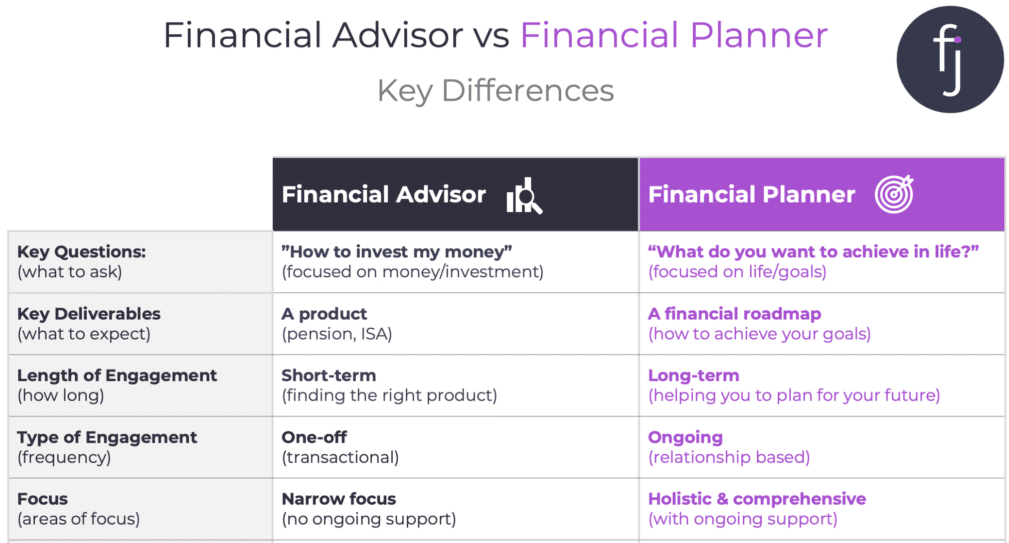

Common instances consist of the FINRA Series 7 and Series 65 examinations for protections, or a state-issued insurance policy certificate for selling life or medical insurance. While credentials may not be lawfully needed for all intending roles, employers and clients usually view them as a benchmark of professionalism. We take a look at optional qualifications in the following area.The majority of financial planners have 1-3 years of experience and familiarity with monetary products, compliance requirements, and straight customer communication. A solid instructional history is essential, yet experience demonstrates the capacity to use concept in real-world setups. Some programs integrate both, enabling you to complete coursework while earning supervised hours through internships and practicums.

The Buzz on Clark Wealth Partners

Early years can bring lengthy hours, pressure to construct a client base, and the demand to constantly confirm your experience. Financial coordinators appreciate the possibility to work very closely with clients, overview important life decisions, and frequently attain versatility in timetables or self-employment.

They spent much less time on the client-facing side of the sector. Almost all monetary managers hold a bachelor's degree, and several have an MBA or comparable graduate level.

Clark Wealth Partners Things To Know Before You Buy

Optional accreditations, such as the CFP, generally call for additional coursework and screening, which can extend the timeline by a number of years. According to the Bureau of Labor Statistics, individual financial consultants earn a mean yearly annual wage of $102,140, with top income earners gaining over $239,000.In other districts, there are regulations that need them to fulfill certain demands to make use of the economic advisor or financial planner titles (retirement planning scott afb il). What establishes original site some economic experts apart from others are education, training, experience and certifications. There are several designations for monetary experts. For economic planners, there are 3 common designations: Licensed, Individual and Registered Financial Organizer.

The 5-Minute Rule for Clark Wealth Partners

Those on income may have an incentive to promote the product or services their employers offer. Where to locate a monetary consultant will rely on the sort of guidance you need. These establishments have personnel who might assist you understand and buy particular sorts of investments. For instance, term deposits, assured financial investment certificates (GICs) and common funds.Report this wiki page